Introduction

Have you ever thought why the government needs foreign currency when the people are still residing in India? Let’s understand this through an example if a person is residing in India and wants to go abroad for the purpose of the job, travelling, education, migration or any other reason requires foreign currency. Similarly, if a person residing outside India and for similar purposes wants to come here then the person requires Indian currency. If an Indian resident goes outside then i.e. outflow of the foreign currency and the person visiting India then that is the inflow of the foreign currency. To manage and balance this inflow and outflow of the foreign currency is the objective. RBI is the governing authority for this management. For this reason, this Act is named as Foreign Exchange Management Act, 1999.

FEMA 1999

Foreign Exchange Regulation Act, 1973 (FERA) was replaced by the Foreign Management Act, 1999 (FEMA). FEMA was enacted by Parliament of India and it came into force on 1st June, 2000. There are a total of 49 Sections divided into 7 chapters. The reason for the replacement emerged because it was not suitable for the prevailing environment and was harsh as it contained a provision for imprisonment.

On the other hand, FEMA was introduced with the changes because of the new, liberal and changing environment.

Also, earlier FERA was passed due to the insufficient foreign exchange in the country and FEMA was passed with the objective to relax the controls on foreign exchange in India.

The head office of FEMA is situated in New Delhi known as Enforcement Directorate and is headed by a Director.

Authorities

- Reserve Bank of India and the Central Government is the controlling authority- Central Government enacts the laws and RBI ensures its enforcement.

- The Directorate of Enforcement is the administrative and managing authority.

Objectives

- To reinforce and amend the law relating to foreign exchange.

- To simplify and ease the external trade and payments.

- To promote the systematized development and maintenance of a healthy foreign exchange market in India.

- To remove disparity of payments.

- To control and direct the employment business and investment of the non-residents.

- To utilise the foreign exchange resources effectively for the country.

Features of FEMA

- FEMA does not apply to the Indian citizens who resides outside India. This criteria is checked by the number of days a person stays in India for more than 182 days in the preceding financial year.

- Central Government has the authority given by FEMA to impose restrictions on and supervise three things which are- payments made to any person outside India or receipts from them, forex and foreign security deals.

- It specified the areas for holding of forex that required specific permission of the Reserve Bank of India (RBI) or the government.

- FEMA classified the transaction into a current and capital account.

To whom it is applicable?

- It is applicable to the whole of India.

- Any branch, office, and agency, which is situated outside India, but it is owned or controlled by a person resident in India. Any violation by these entities committed outside India will be covered under this Act.

In general, FEMA includes three different types of categories and deals separately which are:-

- Person

- A person resident in India

- Person resident outside India

Now let’s discuss them in detail.

Person

For the object of the Act, a person includes the following:-

- An individual,

- A Hindu undivided family,

- A company,

- A firm,

- An association of persons or a body of individuals whether incorporated or not,

- Any artificial judicial person not falling any of the preceding sub-clauses and,

- Any agency office or branch owned or controlled by such person.

Person resident in India

- A person residing in India for more than 182 days during the course of a preceding financial year but it does not include-

- A person who has gone out of India or stays outside India, in any one of the cases-

- for taking up employment outside India, or

- for carrying on outside India a business or vocation, or

- for any other purpose, in such circumstances as would indicate his intention to stay outside India for an uncertain period.

- A person who has come to or stays in India, in any of the following cases-

- for taking up employment in India, or

- for carrying on in India a business or vocation, or

- for any other purpose, in such circumstances, as would indicate his intention to stay in India for an uncertain period.

B. Any person or body corporate registered or incorporated in India.

C. An office, branch or agency in India owned or controlled by a person resident outside India.

D. An office, branch or agency outside India owned or controlled by a person resident in India.

Person resident outside India

It means a person who is not an Indian resident or not a resident in Indian.

Foreign currency

It means any currency but other than Indian currency.

Foreign Exchange

It means foreign currency and it also includes deposits, credits, and balances which are payable in foreign currency. Also the drafts, travellers cheques, letters of credit or bills of exchange which are expressed or drawn in Indian currency but is payable in any foreign currency.

Also, the drafts, travellers cheques, letters of credit or bills of exchange drawn by banks, or any institutions or person outside India but are payable in Indian currency.

Foreign Security

It means any security which is in the form of shares, stocks, bonds, debentures or any other instrument denominated or expressed in foreign currency. It also includes foreign securities which are denominated or expressed in foreign currency, but where the redemption or any form of return on these securities such as interest or dividends should be payable in Indian currency.

Authorised Person

Section 2(c) of the Foreign Exchange Management Act,1999 defines Authorised person. An authorised person is a person who has given the authority for the conversion of the foreign exchange.

For example, if an Indian resident wants to visit the USA and requires their currency which is dollars so for the exchange he/she will only go to the authorised person or if a person residing abroad wants to visit India and requires Indian currency then similarly he/she will approach an authorised person for the foreign exchange.

The Reserve Bank on an application made on this behalf may authorise any person to deal in foreign exchange or in foreign securities. So, an authorised person is governed under this section which states 4 persons as an authorised person-

- Authorised dealer, or

- Money changer, or

- Off-shore banking unit, or

- Any other person for the time being authorised to deal in foreign exchange or foreign securities under Section 10 (1) of FEMA.

Section 10 of the Act in brief

- Authorisation under this Section should be in writing and should be subjected to the regulations mentioned in that. –

- Any authorised person made, the reserve bank at any time can revoke such person if it is satisfied that-

- It is in the public interest to do so; or

- An authorised person has failed to comply with the conditions on the grounds for which the authorisation was granted; or

- the authorised person has violated any of the provisions, rules, regulations mentioned in this Act.

The Reserve Bank may order an authorised person to comply with a general or special direction to deal with the foreign exchange or foreign securities.

And also if any transaction which involves any foreign exchange or foreign currency which is not in compliance with the terms of this provision then an authorised person without any prior permission from the Reserve Bank must not engage in any type of this transaction.

Before undertaking any transaction in foreign exchange on behalf of any person an authorised person shall require the declaration or information of that person that the transaction is not designed for the purpose of contravention of this Act, rule or regulation etc.

If the person refuses to undertake the declaration then an authorised person shall refuse in writing to undertake the transaction and also if the authorised person believes that a person contravenes the provision of the Act can report the matter to the Reserve Bank.

Other than the authorised person, if any person acquires or purchases the foreign exchange and use it for any other purpose which is not permissible under the provisions of this Act or does not surrender within a specified time to the authorised person shall be considered to have committed the violation under the provisions of this Act.

How Inflow and Outflow of Foreign Exchange affects the Current and Capital Account Transaction?

So accounts are broadly classified into:-

- Capital account transaction

- Current account transaction

Capital account transactions- defined under Section 2(e).

It means the transactions which alter or changes the asset or liabilities, including contingent liabilities, outside India of a person resident in India, or

Alters or changes the asset or liabilities, including contingent liabilities in India of a person resident outside India.

And also includes those transactions which are referred to in Section 6(3).

The permissible capital account transactions are defined under the following two categories:

- For person resident in India

- For person resident outside India

For example, Nim, a person resident in India purchases a property in India. Is FEMA applicable to him? The answer to this question is no because there is no involvement of foreign exchange.

To apply FEMA in any transaction the involvement of one person should be from India and the other person should not be a resident in India.

Let’s understand this with another example, Mr. Lucas, a person resident outside India purchases shares of an Indian company. Is FEMA applicable on this transaction? The answer is yes because Mr. Lucas is a person resident outside India and asset and liability is altered of an Indian company then FEMA is applicable.

Current account transaction- defined under Section 2(j).

It means transaction other than a capital account transaction and includes:-

- payments due in connection with foreign trade, other current business, services, and short-term banking and credit facilities in the ordinary course of business,

- payments due as interest on loans and as net income from investments,

- remittances for living expenses of parents, spouse and children residing abroad, and

- expenses in connection with foreign travel, education and medical care of parents, spouse and children.

And any expenditure which is not covered under capital account transaction that will be considered in current account transaction even though it is not mentioned in the above points.

Under this Act, freedom has been provided for selling and drawing of foreign exchange to or from an authorized person for undertaking current account transactions.

However, the Central Government has been vested with powers in consultation with Reserve Bank to impose reasonable restrictions on current account transactions. The Central Government has framed Foreign Exchange Management (Current Account Transactions) Rules, 2000 dealing with various aspects of current account transactions

Restricted transactions include the remittance of lottery winnings, income from racing/riding, purchase of lottery tickets, banned/proscribed magazines, football pools etc.

Also, Nepal and Bhutan allowed the use of Indian currency for local transactions and the citizens of these countries were considered at par with Indian citizens from a legal standpoint. Because of these provisions allowing for a common currency market in India, Nepal and Bhutan, use of forex for transactions in – or with the residents of – Nepal and Bhutan were also prohibited.

Restrictions on dealing in Foreign Exchange

Restrictions on dealing in Foreign exchange are mentioned under Section 3 of the Act, the Section reads as-

- Other than authorized person no person can deal in or transfer any foreign exchange or foreign security to any person.

- In any manner, a person should not make any payment to or for the credit of any person resident outside India.

- Only an authorized person can receive any payment by order or on behalf of any person resident outside India.

Further, Section 4 of the Act states that no person resident in India shall acquire, hold, own, possess or transfer any foreign exchange, foreign security or any immovable property situated outside India.

Export of Goods and Services

Section 7 of this Act states about the export of goods and services.

Every exporter of goods-

- Shall provide to the Reserve Bank or any other authority with a declaration or a statement in such a manner that is specified and should contain true and correct material particulars which should also include the amount representing the full export value. And if the amount is not ascertainable then the prevailing market value should be mentioned.

- It should also provide such other information to the Reserve Bank for the purpose of ensuring the realisation of the export proceeds by such exporter.

- The Reserve Bank may determine the full value of the export goods or reduced value of those goods to ensure that they comply with the prevailing market conditions and to check that it is received without any delay and if not that can direct any exporter to comply which such requirements as it deems fit.

- With regards to the payment of services, every exporter of services shall provide to the Reserve Bank or to any other authority, a declaration in a form and it should be in such a manner which is already specified and also which contains the true and correct material particulars.

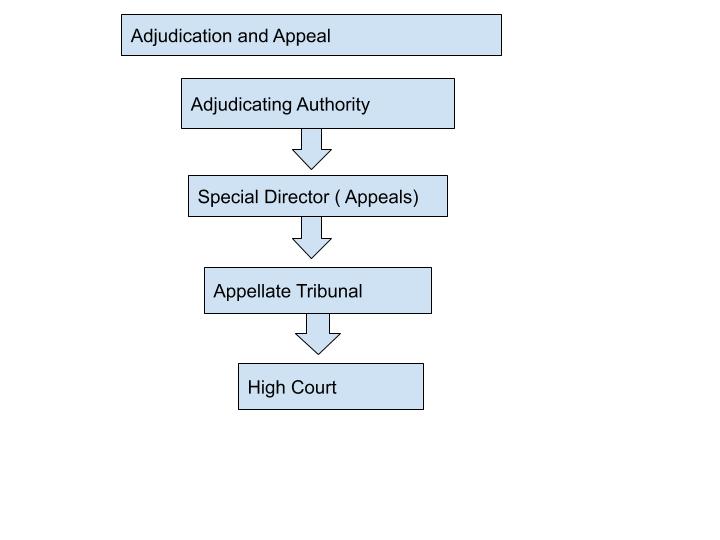

Adjudication and appeal under FEMA

Appointment of Adjudicating Authority

Section 16 states about the appointment of Adjudicating Authority

- The Central Government by publishing an order under the Official Gazette can appoint as many officers of the Central Government as the adjudicating authorities for holding an inquiry in the prescribed manner against whom the complaint has been made.

- The Central Government while appointing the Adjudicating Authorities should also specify in the order published in the Official Gazette about their respective jurisdictions.

- The Adjudicating Authority must hold an enquiry only on a complaint made in writing by an authorised officer through a general or special order by the Central Government.

- The alleged person can appear either in person or can take the assistance of any legal practitioner or a Chartered Accountant to present his case before the adjudicating officer.

- Every Adjudicating Authority must have the same powers of a civil court.

- Every Adjudicating Authority should deal with the complaint diligently and also try to dispose of the complaint within one year from the date of the receipt.

If the Adjudicating Authority fails to dispose of the complaint within the said or specified period then the Authority should give the reasons in writing.

Appeal to Special Director (Appeals)

Section 17 of the Act deals with Appeal to Special Director

- The Central Government by notification should appoint one or more Special Directors (Appeals) to hear appeals against the orders of the Adjudicating Authorities and should also specify in the notification the matter and places in which the Special Director (Appeals) may exercise jurisdiction.

- Being an Assistant Director of Enforcement or a Deputy Director of Enforcement or any other person who is dissatisfied with an order made by the Adjudicating Authority can file an appeal to the Special Director (Appeals).

- When the aggrieved person receives the copy of an order made by the Adjudicating Authority then appeal made shall be filed within forty-five days from that date.

If any person files the appeal after the date of the expiry then it is completely up to the Special Director (Appeals) that he may entertain the appeal once he is satisfied that there was sufficient cause for not filing it within that period.

- The Special Director (Appeals) on receiving the appeal may give the parties to the appeal an opportunity to be heard and if he is satisfied then may pass an order regarding confirming, modifying or setting aside the order appealed against.

- A copy of every order made by the Special Director (Appeals) should be sent to the appellant parties and also to the concerned Adjudicating Authority.

- The Special Director (Appeals) will also have the same powers of a civil court which are conferred on the Appellate Tribunal.

Appellate Tribunal

Section 18 of the Act, talks about the establishment of the Appellate Tribunal which says that the Central Government through a notification may establish an Appellate Tribunal for foreign exchange in order to hear the appeals regarding the orders of the Adjudicating Authorities and the Special Director (Appeals).

Qualifications, for the appointment of Chairperson, Member Special Director (Appeals)

Section 21 of this Act, states the qualifications, for the appointment of Chairperson, Member Special Director (Appeals).

A person shall only be qualified for the appointment if he:

- In the case of a Chairperson- if, he is or has been qualified to be the Judge of High Court.

- In the case of a Member- if, he is or has been qualified to be the Judge of District Court.

- In the case of a Special Director (Appeals)-if he was a member of the Indian Legal Services and in that service held the post of Grade 1, or

Was a member of the Indian Revenue Service and held the post equivalent to a Joint Secretary of the Government of India.

Procedure and powers of Appellate Tribunal and Special Director (Appeals)

Section 28 of the act states that

- Both Appellate Tribunal and Special Director (Appeals) shouldn’t be bound by the procedure of the Code of Civil Procedure instead should be guided by the principle of natural justice and should follow the provisions of this Act.

- While trying any suit both of them should have the same powers as a civil court under the Code of Civil Procedure.

- Any order passed by the Appellate Tribunal or the Special Director (Appeals) under this Act shall be performed or executed by them as a decree of a civil court and, for this purpose both of them must have all the powers of a civil court.

- The Appellate Tribunal or the Special Director (Appeals) can also transfer any order made by it to a civil court having local jurisdiction. And such civil court shall execute the order as if it were a decree made by that court.

Appeal to High Court

If any person is dissatisfied with the decision of the Appellate Tribunal he/she may file an appeal to the High Court within sixty days of that communication of the decision or order.

High Court may give a further extension of sixty-days if the Court is satisfied with the reasons for the delay of the appeal filed by the appellant.

Directorate of Enforcement.

Section 36 of this Act, talks about Directorate of Enforcement

- The Central Government for the purpose of this Act may establish Directorate of Enforcement with a Director and with that other officers or class of officers as the government thinks fit and they will be called as Officers of Enforcement.

- The Director of Enforcement or an Additional Director of Enforcement or a Special Director of Enforcement or a Deputy Director of Enforcement are authorised by the Central Government to appoint officers of Enforcement below the rank of an Assistant Director of Enforcement.

- The officer of Enforcement can exercise his powers and duties apart from the limitations or conditions imposed on him by the Central Government under this Act.

Power of search, seizure, etc.

Section 37 of the Act states that

- If any person violates or contravenes any rule, provision, order etc. which was restricted or specifically mentioned not to do then the Director of Enforcement and other officers of Enforcement above the rank of an Assistant Director can only investigate.

- Through a notification the Central Government can authorise any officer or class of officers in the Central Government, State Government or the Reserve Bank, to investigate any contravention.

- Similar powers which are conferred on the Income-tax authorities under the Income-tax Act, 1961 should be exercised by the officers and shall exercise such powers, subject to such limitations laid down under that Act.

Structure to appeal when the party is aggrieved

Contraventions and Penalties

If any person contravenes any provision, rule, order, regulation or direction of this Act. The person will be liable to pay the fine for that contravention and thrice the amount which is mentioned in the Act where the violation is measurable or up to two lakh rupees where the amount cannot be determined or measured. Also where such violation is a continuing one then a further penalty will be extended to five thousand rupees every day.

Any Adjudicating Authority adjudging any contravention and if he thinks fit or is satisfied with the violation done then in addition to any penalty he may direct the party who is responsible for this contravention, that any currency, property, security or money in respect of which the contravention has taken place shall be confiscated to the Central Government and further direct that if there are any foreign exchange holdings of the persons committing the contraventions must be brought back into India or must be retained outside India in accordance with the directions made in this behalf.

If any person fails to make full payment of the penalty imposed on him within a period of ninety days from the date on which the notice for payment of such penalty is served on him, he shall be liable to civil imprisonment.

Difference between FERA and FEMA

Basis

FERA

FEMA

Meaning

FERA was implemented to regulate foreign payments and to ensure optimum use of foreign currency in India.

FEMA aims to promote foreign trade, foreign payments and to increase the size of foreign exchange reserve in the country.

Enactment

It is an old enactment and was approved by the Parliament in the year 1973.

It is a new enactment and was approved by the Parliament in the year 1999 and is currently in force.

Number of Sections

It had 81 Sections.

It has 49 Sections divided into 7 chapters.

When this was introduced(position of foreign exchange)

When foreign exchange reserves were very low.

When foreign exchange reserves were adequate but required regulation and balance.

Outlook towards foreign exchange reserves.

A rigid approach was there.

A flexible approach is there.

Determining the residential status

Through citizenship only it was determined.

More than 182 days/ 6 months stay in India.

Transfer of funds

A person has to take permission from RBI relating to the transfer of funds to external operations.

There is no requirement of the pre-approval from RBI regarding the transfer of funds relating to the external operations, funds or trade.

contravention/violation

If any violation of the provision or order then it will be considered as a criminal offence.

If any violation of the provision or order then it will be considered as a civil offence.

Punishment for the violation

The guilty person will be sentenced to imprisonment.

The guilty person will be held liable to pay a fine and if the fine is not paid within stipulated time then will be sentenced to imprisonment.

Conclusion

FEMA only permits an authorized person to deal in Foreign exchange or foreign security ( shares, stocks, bonds etc). FEMA became the need of an hour to be replaced by an old act which was FERA as FERA was stringent and FEMA is liberal and also more flexible than FERA.

Any person who wants to do business in a foreign country or to buy foreign securities he/she needs an authorised person to do that and also to understand this Act in order to avoid penalties and he/she should also be aware of the restrictions on it.

The main objective of FEMA was to consolidate and amend the laws relating to the foreign exchange with the reason to facilitate the external trade and payments and for the maintenance of the foreign exchange market in India. FEMA’s replacement with FERA to an extent has boosted the Indian economy as it is flexible and also a civil offence in comparison with FERA.

References

- http://www.caaa.in/Image/fema2011.pdf

- https://keydifferences.com/difference-between-fera-and-fema.html

- http://www.yourarticlelibrary.com/economics/foreign-exchange/fema-provisions-of-foreign-exchange-management-act/39542

- https://www.vakilno1.com/bareacts/fema/fema.html

- http://www.enforcementdirectorate.gov.in/ForeignExchangeManagementAct1999.pdf?p1=117211488412800030

- http://legislative.gov.in/sites/default/files/A1999-42_0.pdf